Are you wondering about cool projects to explore in the world of numbers and money? Well, buckle up because we’re about to dive into an awesome list of Accounting Project Topics And Materials designed just for you!

You might be thinking, ‘What’s so exciting about accounting?’ Trust me, it’s not just about counting coins. These topics are like treasure chests filled with fascinating ideas. From learning how businesses handle their cash to uncovering the secrets behind financial statements, taxation, and even catching financial fraudsters—there’s a whole bunch of interesting stuff waiting for you.

Think of these topics as your ticket to understanding how money moves in the business world. Ever wondered how companies figure out what to spend and where to save? Or how do they make sure everything adds up correctly? Well, these projects will give you a sneak peek into those secrets.

So, get ready to explore, learn, and become the next financially proficient youth with these awesome Accounting Project Topics And Materials! Let’s get started on this money-making adventure together!

Must Know: Insurance Project Ideas

What Are The Best Accounting Project Topics?

Selecting the finest Accounting Project Topics involves thoughtful consideration of subjects that open doors to comprehensive learning experiences. These topics are carefully curated to offer students engaging insights into the intricate world of finance and accounting. Ranging from dissecting financial statements and understanding taxation principles to exploring the nuances of cost accounting and auditing practices, these topics serve as pathways to comprehend essential financial management concepts.

They aim not only to broaden students’ horizons but also to instill practical skills and analytical thinking crucial for navigating the complexities of the accounting domain. The best Accounting Project Topics and materials are those that serve as bridges between theoretical knowledge and practical application. They act as catalysts for deeper understanding by immersing students in topics such as ethics in accounting, international standards, risk management strategies, and the integration of technology in modern accounting systems.

How Do You Select A Very Good Topic For Your Graduation Project In The Accounting Section?

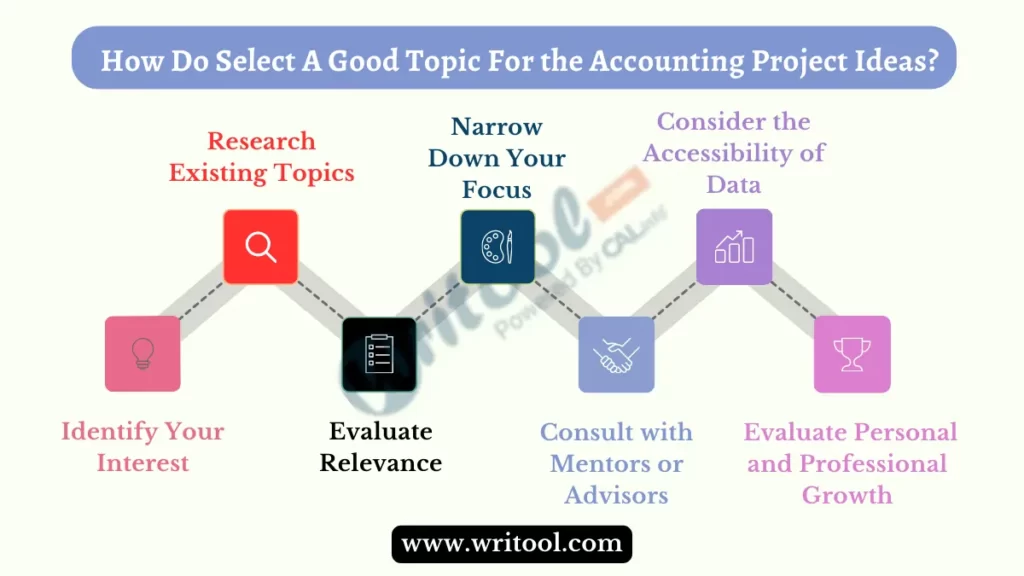

Here are 7 easy steps to help you choose an excellent topic for your graduation project in the accounting section:

1. Identify Your Interests

Start by listing areas of accounting that captivate your attention. Whether it’s auditing, taxation, financial analysis, or cost accounting, understanding your interests will guide you toward a topic that keeps you engaged throughout your project.

2. Research Existing Topics

Explore various resources like textbooks, journals, online databases, and academic websites to discover existing topics in accounting. This can inspire new ideas or help you refine existing ones by understanding what has been previously studied.

3. Evaluate Relevance

Consider the relevance and significance of potential topics. Ensure the chosen subject aligns with current trends, addresses practical issues, or offers solutions to existing problems in the accounting field.

4. Narrow Down Your Focus

Once you have a list of potential topics, narrow it down based on feasibility, resources available, and the scope of your project. Aim for a specific aspect within a broader topic to maintain focus and depth.

5. Consult with Mentors or Advisors

Seek guidance from professors, mentors, or advisors. Discuss your ideas with them to receive valuable insights, suggestions, and feedback. Their expertise can help you refine your topic and ensure its academic viability.

6. Consider the Accessibility of Data

Ensure that you can access the necessary data and resources to support your research. A feasible project topic should have readily available information for analysis and study.

7. Evaluate Personal and Professional Growth

Lastly, reflect on how the chosen topic aligns with your academic and career goals. Consider how researching this topic might contribute to your knowledge, skills, and future aspirations in the field of accounting.

List of 189+ Best Accounting Project Topics And Materials For Students

These topics cover various areas within accounting and can be further developed into project proposals or research papers:

Good Financial Accounting Project Topics And Materials

- Impact of Financial Reporting Quality on Investment Decisions

- Evaluation of Accounting Conservatism in Financial Statements

- Adoption and Implementation of International Accounting Standards in Developing Countries

- Assessing the Effectiveness of Accounting Information in Stock Market Predictions

- Corporate Disclosure Practices and Investor Confidence

- Financial Statement Analysis of Multinational Corporations

- Accounting for Leases under IFRS 16 vs. ASC 842: A Comparative Analysis

- Accounting for Intangible Assets: Valuation and Reporting Issues

- Financial Reporting and Corporate Social Responsibility (CSR) Disclosures

- The Role of Accounting in Mergers and Acquisitions

Recent Managerial Accounting Project Topics And Materials

- Throughput Accounting: Theory and Practical Application in Manufacturing

- Target Costing in New Product Development: Case Studies in Different Industries

- Performance Measurement Systems in Service Industries

- Cost Management Techniques in Healthcare Organizations

- Transfer Pricing Strategies and Their Impact on Multinational Corporations

- Strategic Cost Analysis for Decision-Making in Competitive Markets

- Environmental Management Accounting Practices in Sustainable Businesses

- Activity-Based Budgeting: Implementation Challenges and Benefits

- Cost Allocation Methods and Their Effect on Profitability Analysis

- Management Accounting Techniques for Non-Profit Organizations

Auditing and Assurance

- Audit Committee Effectiveness and its Impact on Financial Reporting Quality

- Role of Big Data Analytics in Auditing Procedures

- Auditor Liability: Legal and Ethical Implications

- The Impact of Corporate Governance on External Audit Quality

- Auditing in the Era of Industry 4.0: IoT, AI, and Automation

- Forensic Audit Techniques in Fraud Detection and Prevention

- Internal vs. External Audits: Comparative Analysis and Advantages

- The Evolution of Audit Reports: Past, Present, and Future Trends

- Assessing Audit Risk in Complex Business Environments

- Continuous Auditing and its Application in Contemporary Businesses

Taxation And Accounting Project Topics And Materials

- Tax Compliance and Ethics: A Comparative Study Across Countries

- Taxation Policies and Economic Development: Lessons from Emerging Markets

- Tax Incentives and Investment Decisions in Developing Economies

- Taxation of E-commerce Transactions: Challenges and Opportunities

- Tax Implications of Cryptocurrency Transactions

- Environmental Taxation and its Role in Sustainable Development

- Tax Planning Strategies for High-Net-Worth Individuals

- Tax Reform Proposals and Their Socioeconomic Impact

- Taxation of Multinational Corporations: Transfer Pricing Issues

- Tax Treaties and their Influence on International Business Transactions

Forensic Accounting

- Corporate Governance and Fraudulent Financial Reporting

- Cybersecurity Risks in Financial Systems and Forensic Countermeasures

- Whistleblowing Policies and Their Role in Fraud Detection

- Digital Forensics and Investigation Techniques in Financial Crimes

- The Use of Artificial Intelligence in Forensic Accounting

- Investigating Embezzlement and Financial Misconduct in Organizations

- The Role of Forensic Accountants in Dispute Resolution

- Money Laundering: Detection and Prevention Strategies

- Forensic Accounting Techniques in Bankruptcy Cases

- Ethical Dilemmas and Challenges in Forensic Accounting Investigations

Accounting Information Systems

- ERP Systems Implementation and its Impact on Accounting Processes

- Cloud Computing in Accounting Information Systems

- Data Analytics in AIS: Enhancing Decision-Making Processes

- Information Security in Accounting Information Systems

- Blockchain Technology in Financial Reporting and Auditing

- AIS and Corporate Governance: Ensuring Data Integrity and Security

- AI-Powered Predictive Analytics in Financial Reporting

- The Evolution of AIS and its Future Trends

- AIS in Small and Medium-sized Enterprises (SMEs): Challenges and Opportunities

- Mobile Accounting Applications: Advantages and Risks

Easy Ethics in Accounting Project Topics And Materials

- Professional Ethics in Accounting: Codes and Practices

- Ethical Leadership and its Impact on Financial Reporting Integrity

- Conflicts of Interest in Accounting: Analysis and Mitigation Strategies

- Corporate Social Responsibility (CSR) and Ethical Accounting Practices

- Ethical Decision-Making in Accounting: Case Studies

- The Role of Ethics in Accounting Education and Professional Development

- Whistleblowing and Ethical Dilemmas in Accounting Firms

- Ethical Challenges in Tax Planning and Compliance

- Gender Diversity in Accounting and Ethical Implications

- Ethical Issues Surrounding Creative Accounting Practices

Accounting for Specific Industries

- Hospitality Industry Accounting Practices and Challenges

- Accounting in the Pharmaceutical Industry: Regulations and Reporting Standards

- Accounting for Government and Non-Governmental Organizations (NGOs)

- Agricultural Accounting: Challenges and Solutions

- Financial Reporting in the Entertainment Industry

- Real Estate Accounting and Property Management

- Healthcare Accounting: Revenue Recognition and Cost Control

- Accounting Practices in the Fashion and Retail Industry

- Aviation Industry Accounting: Revenue Management and Cost Analysis

- Accounting for the Energy Sector: Challenges and Environmental Reporting

Financial Regulation and Compliance

- Dodd-Frank Act and its Impact on Financial Reporting

- Basel Accords and their Influence on Banking Regulations

- Financial Regulatory Reforms post-Global Financial Crisis

- Compliance with Anti-Money Laundering (AML) Regulations in Financial Institutions

- Role of Central Banks in Ensuring Financial Stability

- Regulatory Challenges in Fintech and Digital Banking

- Insider Trading Regulations: Case Studies and Implications

- Credit Risk Management and Regulatory Compliance

- Corporate Governance Regulations and Financial Performance

- Regulatory Changes and Their Effects on Financial Markets

International Accounting Project Topics And Materials

- International Tax Planning Strategies for Multinational Corporations

- Cross-Border Mergers and Acquisitions: Accounting and Reporting Challenges

- Harmonization of Accounting Standards: Achievements and Challenges

- The Impact of Globalization on Accounting Practices

- International Financial Reporting Standards (IFRS) and US GAAP Convergence

- Comparative Analysis of Accounting Systems in Different Countries

- Challenges of Foreign Currency Translation in International Accounting

- International Accounting and Reporting in Developing Economies

- Accounting Harmonization in the European Union

- Cultural Influences on Accounting Practices in Global Businesses

Accounting Education and Profession

- Pedagogical Techniques in Teaching Accounting to Students

- The Role of Technology in Accounting Education

- Accounting Skills and Competencies for Future Professionals

- Continuous Professional Development in Accounting: Challenges and Solutions

- The Influence of Internships on Accounting Students’ Career Choices

- Gender Disparity in the Accounting Profession

- Accounting Accreditation and its Impact on Education Quality

- Ethics Education in Accounting Programs: Curricular Design and Effectiveness

- The Future of Accounting: Emerging Roles and Career Prospects

- Professional Certifications in Accounting: Benefits and Challenges

Financial Management and Analysis

- Working Capital Management Strategies and Firm Performance

- Capital Budgeting Techniques in Investment Decision-Making

- Financial Risk Management in Global Corporations

- Corporate Restructuring and Financial Performance

- Merger and Acquisition Valuation Methods

- Dividend Policy and its Impact on Shareholder Wealth

- Initial Public Offerings (IPOs) and Stock Market Performance

- Corporate Cash Holdings and Firm Value

- Behavioral Finance: Biases in Investment Decision-Making

- Corporate Governance and Financial Distress Prediction Models

Accounting for Non-Profit Organizations

- Financial Sustainability of Non-Profit Organizations

- Donor Stewardship and Financial Accountability in NGOs

- Fund Accounting and Grant Management in Non-Profit Entities

- Performance Measurement in Non-Profit Organizations

- Budgeting and Financial Planning in Non-Profit Sector

- Reporting Requirements for Non-Profit Entities

- Fundraising Strategies and Financial Reporting for Non-Profits

- Volunteer Services and their Valuation in Non-Profit Accounting

- Compliance and Governance Challenges for Non-Profit Organizations

- Impact Assessment and Reporting in Non-Profit Sector

Accounting for Small Businesses and Startups

- Accounting Practices for Small Business Sustainability

- Financial Reporting Challenges for Small Businesses

- Start-up Financing Options and Accounting Implications

- Cash Flow Management in Small Businesses

- Tax Planning Strategies for Small and Medium-sized Enterprises (SMEs)

- Accounting Software for Small Business: Selection and Implementation

- Financial Decision-Making in Startup Ventures

- Accounting for Intellectual Property in Startups

- Challenges of Financial Management in Growing Small Businesses

- Cost Accounting for Small-Scale Manufacturing Units

Accounting in Developing Economies

- Accounting Infrastructure in Developing Countries

- Challenges of Implementing International Accounting Standards in Developing Economies

- Corporate Governance in Emerging Markets

- Accounting for Microfinance Institutions in Developing Nations

- Public Sector Accounting Reforms in Developing Economies

- Financial Reporting Challenges in Less-Developed Countries

- Role of Informal Economies in Accounting Practices

- Accounting for Poverty Alleviation Programs

- Challenges of Taxation in Developing Nations

- Accounting Education in Developing Economies

Environmental Accounting Project Topics And Materials

- Environmental Accounting Standards and Reporting Frameworks

- Carbon Accounting and Emission Trading

- Environmental Cost Accounting: Measurement and Reporting

- Social and Environmental Responsibility Reporting by Corporations

- Ecological Footprint Accounting in Organizations

- Sustainability Reporting and Triple Bottom Line Accounting

- Environmental Management Accounting for Business Decision-Making

- Green Accounting: Benefits and Implementation Challenges

- Renewable Energy Accounting and Financial Reporting

- Environmental Auditing and Compliance Reporting

Accounting and Technology

- Accounting Automation and its Effects on Employment

- Robotic Process Automation in Accounting and Finance

- Accounting Information Systems Integration with AI and Machine Learning

- Cybersecurity Measures in Accounting Information Systems

- Cloud-Based Accounting Solutions: Advantages and Risks

- Big Data Analytics in Accounting: Applications and Limitations

- Role of Blockchain in Accounting and Financial Transactions

- Mobile Applications for Personal Financial Management

- AI-powered Financial Planning and Analysis Tools

- Digital Transformation in Accounting Firms

Accounting and Social Issues

- Impact Investing and Social Accounting

- Gender Pay Gap Reporting and its Financial Implications

- Diversity and Inclusion Reporting in Corporate Financial Statements

- Corporate Philanthropy Reporting and its Effect on Stakeholders

- Income Inequality and its Reflection in Financial Reporting

- Human Rights and Corporate Accountability Reporting

- Social Impact Measurement in Financial Reporting

- Corporate Ethics and Social Responsibility Reporting

- Accounting for Sustainable Development Goals (SDGs)

- Fair Trade Accounting and Reporting

Accounting in Specific Geographic Regions

- Accounting Practices in Asia-Pacific Countries

- Accounting Standards and Regulations in Latin America

- Accounting Challenges in African Nations

- European Union Accounting Harmonization and its Implications

- North American Accounting Regulations and Practices

- Accounting Differences in Middle Eastern Countries

- Accounting Reforms and Practices in BRICS Nations

- Accounting Challenges in Post-Soviet Bloc Countries

- Accounting Practices in Pacific Island Nations

- Comparative Analysis of Accounting Systems in Developed vs. Developing Nations

Accounting and Governance

- Corporate Governance Mechanisms and Financial Reporting Quality

- Board Diversity and Financial Performance of Companies

- Shareholder Activism and Corporate Governance

- Corporate Social Responsibility and Board Oversight

- Governance Mechanisms in Family-Owned Businesses

- Executive Compensation and Corporate Governance

- Role of Auditors in Corporate Governance

- Governmental Influence on Corporate Governance Practices

- Whistleblowing Policies and Corporate Governance

- Stakeholder Theory and Corporate Governance

Best Accounting Project Materials For Students

Here, we give various types of educational, professional, and other materials commonly used in the field of accounting, including some examples and potential categories.

1. Educational Materials

Textbooks

Textbooks play a crucial role in accounting education, covering fundamental concepts to specialized areas. Here’s a table showcasing some popular accounting textbooks:

| Textbook Title | Author(s) | Description |

|---|---|---|

| “Financial Accounting: Tools for Business Decision Making” | Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso | Covers basic principles of financial accounting with real-world examples. |

| “Cost Accounting: A Managerial Emphasis” | Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan | Focuses on cost management, cost analysis, and decision-making for managers. |

| “Auditing and Assurance Services” | Alvin A. Arens, Randal J. Elder, Mark S. Beasley | Covers auditing concepts, standards, and practices in assurance services. |

Online Courses

Online platforms offer a variety of accounting courses. Here are examples from different levels:

| Platform | Course Title | Description |

|---|---|---|

| Coursera | “Financial Accounting Fundamentals” | A beginner-level course covering basic accounting principles. |

| Udemy | “Intermediate Accounting: Advanced Topics” | An intermediate course focusing on complex accounting topics. |

| LinkedIn Learning | “CPA Exam Review“ | Advanced-level course to prepare for the Certified Public Accountant (CPA) exam. |

Lecture Notes and Slides

Universities and colleges often provide lecture materials online. Here’s how a table might categorize these:

| Institution | Course Title | Description |

|---|---|---|

| Harvard University | “Financial Reporting” | Lecture slides and notes covering financial reporting standards and practices. |

| Stanford University | “Taxation Law” | Lecture materials discussing tax laws, regulations, and case studies in taxation. |

| MIT OpenCourseWare | “Managerial Accounting” | Lecture notes on managerial accounting, budgeting, and cost management. |

2. Professional Materials

Accounting Standards and Pronouncements

Accounting standards issued by various bodies are crucial for professionals. Here’s a potential table layout:

| Standard Issuer | Standard Name | Description |

|---|---|---|

| International Accounting Standards Board (IASB) | IFRS 15: Revenue from Contracts with Customers | Provides guidelines on recognizing revenue from contracts with customers. |

| Financial Accounting Standards Board (FASB) | FASB ASC 606: Revenue Recognition | Guidance on revenue recognition principles across various industries. |

| Governmental Accounting Standards Board (GASB) | GASB Statement No. 34: Basic Financial Statements | Prescribes reporting standards for state and local governments. |

Journal Articles and Research Papers

Research papers and articles contribute to accounting knowledge. Here’s an example table structure:

| Title | Authors | Publication | Description |

|---|---|---|---|

| “The Impact of IFRS Adoption on Financial Reporting Quality” | John Smith, Emily Johnson | Journal of Accounting Research | Investigates the effects of IFRS adoption on financial reporting. |

| “Fraud Risk Factors and Auditors’ Response” | David Brown, Sarah Clark | Accounting Review | Analyzes fraud risk factors and auditor actions in response. |

Software

Accounting software aids in managing financial tasks. A table could display different software options:

| Software Name | Developer | Description |

|---|---|---|

| QuickBooks | Intuit | Small business accounting software for bookkeeping and invoicing. |

| Xero | Xero Limited | Cloud-based accounting software for businesses of all sizes. |

| SAP ERP | SAP SE | Enterprise resource planning software integrating accounting modules. |

3. Other Materials

Calculators

Financial calculators are essential tools in accounting. A simple table might look like this:

| Calculator Model | Manufacturer | Description |

|---|---|---|

| HP 12C Financial | HP | Popular financial calculator for time value of money calculations. |

| Texas Instruments BA II Plus | Texas Instruments | Common calculator for financial and statistical calculations. |

Templates and Spreadsheets

Pre-made templates and spreadsheets streamline accounting tasks. Here’s a sample table layout:

| Template/Spreadsheet Name | Use Case | Description |

|---|---|---|

| Budget Template | Personal/Corporate Budgeting | Template to manage and track expenses against a budget plan. |

| Financial Analysis Sheet | Financial Statement Analysis | Spreadsheet for ratio analysis and financial statement interpretation. |

News and Analysis

Staying updated with current business news is vital for accountants. A table could display different news sources:

| News Source | Description |

|---|---|

| Bloomberg | Financial news and market analysis. |

| Financial Times | Global business and economic news. |

| CNBC | Business news and stock market updates. |

List of Simple accounting project topics and materials PDF

Here are the simplest final-year project topics for accounting students and good Accounting project topics and materials for college students.

What Are Some Creative Project Topics For Accountancy And Oc?

Here are ten creative project topics that blend Accountancy (Accounting) with Organizational Communication (OC):

- Communication Strategies in Financial Reporting: Analyzing how effective communication enhances the comprehension of financial reports for diverse stakeholders.

- Ethical Communication in Accounting Practices: Investigating how ethical communication influences decision-making processes within accounting firms and financial organizations.

- Impact of Digital Transformation on Accounting Communication: Exploring how technological advancements affect communication practices in accounting, such as through automation and AI.

- Narrative Accounting: Storytelling in Financial Reporting: Examining the use of storytelling techniques in financial statements and their impact on stakeholders’ understanding.

- Cross-Cultural Communication Challenges in Global Accounting Firms: Studying communication barriers and strategies in multinational accounting corporations operating in diverse cultural settings.

- Communication Styles and Conflict Resolution in Accounting Teams: Analyzing various communication styles within accounting teams and their role in resolving conflicts and enhancing productivity.

- Internal Communication and Change Management in Accounting Practices: Investigating effective internal communication strategies during organizational changes within accounting firms.

- Role of Communication in Forensic Accounting Investigations: Examining how communication techniques aid in conducting successful forensic accounting investigations.

- Communicating Sustainability in Financial Reporting: Exploring the communication of sustainable accounting practices and environmental/social impact in financial reports.

- Communication and Client Relationships in Accounting Services: Investigating the significance of effective communication in maintaining client relationships and delivering quality accounting services.

Conclusion

So, these ‘Accounting Project Topics and Materials’ are all about money and how it works in different places. Imagine them like different doors you can open to learn cool things about numbers and businesses. They show how people use math to talk about money in companies, how new tech helps with accounting, and even how working together in accounting teams is super important. It’s not just about numbers; it’s like discovering secrets about money in the real world. These materials are like a treasure map, helping us explore and understand how money decisions are made in companies, charities, and more.

These ‘Accounting Project Topics and Materials’ are a bit like a fun book series but about money and business. They’re packed with stories about how people handle cash and make smart choices. From learning about how companies talk about money to discovering new ways technology helps count coins, these topics are like puzzle pieces that make up the big picture of money. They’re a guide to exploring how cash moves around and how people make decisions with it.

FAQs

What are examples of projects in accounting?

An example of a project in accounting could involve conducting a financial statement analysis to evaluate a company’s performance and financial health.

What is a good project for a recent accounting graduate

A comprehensive project in forensic accounting investigating financial fraud or irregularities within an organization could be valuable for a recent accounting graduate.

How do I get the best accounting project topics?

Exploring recent industry trends, consulting academic resources, and discussing potential ideas with mentors or professors can help in identifying the best accounting project topics.