Are you a student or an aspiring writer looking for interesting taxation project ideas? Look no further! In this article, we will explore 101+ interesting taxation project ideas categorized across various fields.

Exploring these projects provides a unique opportunity to understand the complex nuances of tax systems while addressing current challenges and innovations.

One intriguing project idea involves analyzing the impact of digital currencies on taxation frameworks worldwide. Exploring the tax collection, administrative ramifications, and potential arrangement transformations of cryptocurrencies, for example, Bitcoin or Ethereum, in light of this rising monetary scene could be an illuminating undertaking.

Taxation is an elaborate web that links with every part of our lives, from individual finances to corporate strategies. Delving into taxation projects can solve a plethora of intriguing ideas. Here’s a comprehensive guide exploring various intriguing taxation project ideas across diverse fields.

Also Like To Know: Interesting Essay Topics For College Students

What Is Taxation In Real-Life Examples?

Taxation is the process by which governments collect cash from people and organizations within their wards to support public administrations and frameworks. It’s a fundamental part of a working society and supports various taxpayer-supported initiatives, including schooling, medical services, guard, transportation, and social welfare.

Real-Life Examples Of Taxation Include:

| Type of Taxation | Real-Life Examples |

| Income Tax | Consumers pay a percentage on goods and services purchased, varying by state or country, e.g., state sales tax in the US. |

| Sales Tax | Taxes impoed on goods imported into a country vary based on the type of goods and trade agreements, such as tariffs on imported electronics or automobiles. |

| Property Tax | Individuals pay a percentage of their earnings to the government, such as through the IRS in the United States. |

| Corporate Tax | Homeowners or property owners pay taxes based on the assessed value of their properties, funding local services like schools or infrastructure maintenance. |

| Value-Added Tax (VAT) | Added at different stages of production or distribution, borne ultimately by the end consumer, such as VAT in the European Union or Goods and Services Tax (GST) in various countries. |

| Customs Duties | Taxes imposed on goods imported into a country vary based on the type of goods and trade agreements, such as tariffs on imported electronics or automobiles. |

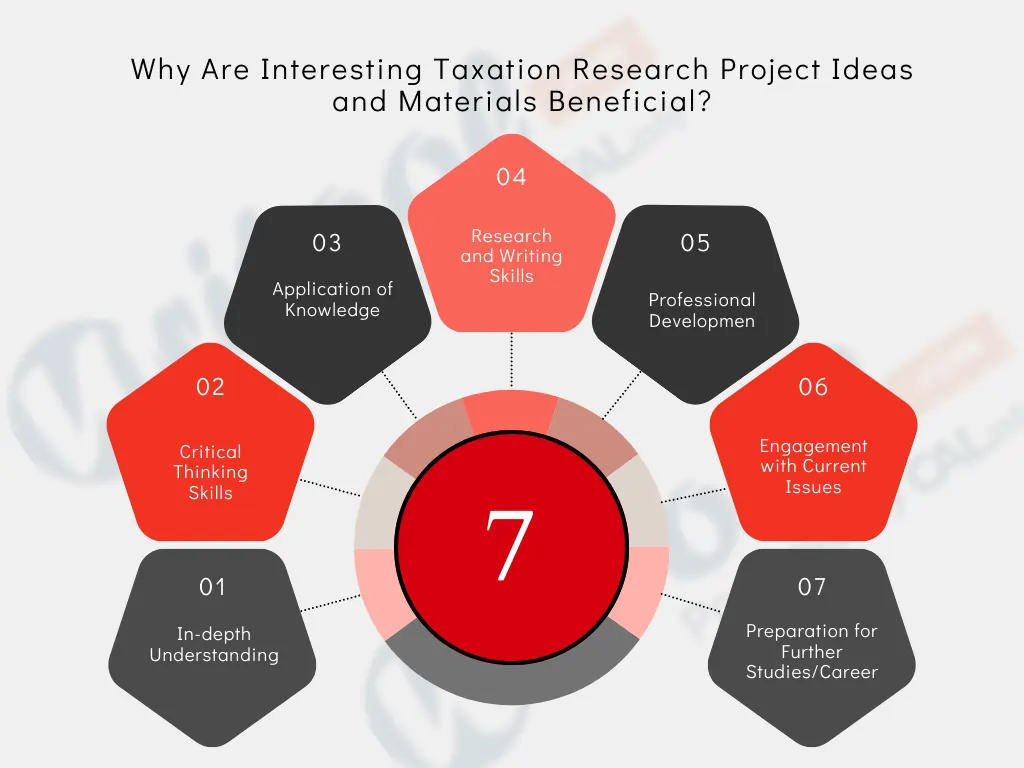

Why Are Interesting Taxation Research Project Ideas and Materials Beneficial?

Taxation undergraduate research project topics and materials offer several benefits to students:

1. In-depth Understanding

Engaging in research projects allows students to delve deeply into specific taxation topics, promoting a comprehensive understanding of tax laws, policies, and their implications. This deeper knowledge enhances their grasp of complex tax systems.

2. Critical Thinking Skills

Research projects require critical analysis, data assessment, and the ability to synthesize findings. Through these projects, students develop decisive reasoning and scientific abilities that are pivotal for interpreting charge regulations and solving real-world taxation issues.

3. Application of Knowledge

Research projects provide a platform for students to apply theoretical concepts learned in classrooms to real-world scenarios. This practical application enhances their ability to address practical tax problems and situations.

4. Research and Writing Skills

Undertaking research projects hones students’ research and writing abilities. It encourages them to locate, assess, and cite relevant sources while presenting their findings coherently and structured. These skills are valuable not only in academia but also in professional settings.

5. Professional Development

Through these projects, students develop proficient abilities, such as managing the project, using time effectively, and showing skills. These adaptable abilities are gainful in different professions, including charge consultancy, accounting, finance, and policymaking.

6. Engagement with Current Issues

Research projects often involve investigating current trends, reforms, or challenges in taxation. Engaging with contemporary issues helps students stay updated with the latest developments in tax laws and policies.

7. Preparation for Further Studies/Career

Undertaking research projects in tax collection can establish a strong starting point for those seeking additional tax collection, accounting, economics, or law. It likewise gives an upper hand to those entering the labor force, as it features their mastery and obligation to the field.

List of Interesting Taxation Project Ideas To Write About & Examples

Following are the most interesting taxation project ideas for students.

Personal Finance Interesting Taxation Project Ideas

- Maximizing Tax Deductions for Savings

- Strategies for Year-round Tax Planning

- Tax-Efficient Investment Portfolios

- Understanding Tax Credits and Rebates

- Exploring Tax Implications of Side Hustles

- Tax Benefits of Retirement Plans

- Tax Strategies for Homeownership

- Estate Planning and Tax Considerations

- Taxation of Investment Gains and Losses

- Tax Implications of Educational Expenses

Corporate Taxation Project Concepts

- Innovative Compliance Approaches for Corporations

- Tax Incentives Driving Corporate Social Responsibility

- Tax Planning for Mergers and Acquisitions

- Transfer Pricing Strategies

- Tax Implications of International Expansion

- Intellectual Property Taxation Strategies

- Tax Efficiency in Capital Structure

- Tax Considerations for Employee Benefits

- Corporate Tax Planning for Non-Profit Organizations

- Tax Optimization in Supply Chain Management

Taxation Projects in Real Estate

- Optimizing Taxes in Property Investment

- Case Studies on Successful Real Estate Tax Strategies

- Tax Considerations for Rental Properties

- Tax Benefits of Real Estate Development

- Understanding Property Tax Assessments

- Tax Implications of Flipping Properties

- Property Tax Strategies for Landlords

- Tax Implications of Real Estate Crowdfunding

- Energy-Efficient Property Tax Credits

- Green Building Tax Incentives

Taxation and Technology

- AI Transformation in Tax Analytics

- Blockchain Solutions for Tax Compliance

- Role of Big Data in Taxation Projects

- Cybersecurity Measures in Tax Data Management

- Integration of IoT in Taxation Systems

- Automation in Tax Filing Processes

- Cloud-Based Tax Management Solutions

- Tax Implications of Digital Assets

- Regulatory Challenges in Fintech Taxation

- Taxation in the Sharing Economy

Environmental Interesting Taxation Project Ideas

- Tax Incentives for Green Investments

- Exploring Carbon Tax

- Tax Credits for Energy-Efficient Practices

- Green Bonds and Tax Implications

- Renewable Energy Tax Benefits

- Sustainable Agriculture Tax Credits

- Carbon Offsetting Tax Strategies

- Biodiversity Preservation Tax Incentives

- Taxation in Waste Management

- Environmental Impact Bonds and Taxation

Global Taxation Challenges

- Navigating Cross-Border Tax Issues

- Successful Multinational Tax Strategies

- Transfer Pricing Regulations in Multinational Companies

- Taxation in Free Trade Zones

- Tax Treaties and their Impact on Global Business

- Tax Implications of Brexit

- Double Taxation Avoidance Agreements

- Taxation in Special Economic Zones

- Taxation in Offshore Financial Centers

- Harmonization of International Tax Policies

Interesting Taxation Project Ideas For High School

- Tax Impact on Educational Finances

- Innovative Tax Initiatives in Education

- Tax Implications for Student Loans

- Tax Exemptions for Educational Institutions

- Tax Benefits for Education Savings Plans

- Tax Credits for Education Expenses

- Taxation of Scholarships and Grants

- Tax Strategies for Educational Endowments

- Tax Planning for Educational Nonprofits

- Tax Considerations for Education Abroad Programs

Healthcare and Taxation

- Tax Implications on Healthcare Services

- Tax Planning for Medical Professionals

- Tax Benefits for Health Savings Accounts

- Tax Considerations for Healthcare Providers

- Tax Impacts on Pharmaceutical Companies

- Taxation of Health Insurance Premiums

- Nonprofit Healthcare Tax Exemptions

- Tax Incentives for Medical Research

- Taxation in Telemedicine Services

- Tax Treatment of Medical Expenses

E-Commerce Interesting Taxation Project Ideas

- Addressing VAT and Sales Tax Challenges in E-Commerce

- Efficient Jurisdictional Tax Planning for E-Commerce

- Tax Implications of Cross-Border E-Commerce

- Tax Compliance in Online Marketplaces

- Cryptocurrency Taxation in E-Commerce

- Taxation of Digital Services

- Taxation of Subscription-Based Services

- Tax Considerations for Online Advertising

- Taxation in Digital Goods and Downloads

- Global VAT/GST Compliance for E-Commerce Businesses

Taxation in Startups

- Tax Considerations for Startup Businesses

- Case Studies of Successful Startup Tax Strategies

- Tax Credits for Research and Development

- Tax Implications of Crowdfunding for Startups

- Tax Planning for Seed Funding

- Taxation of Equity-Based Compensation

- Intellectual Property Tax Strategies for Startups

- Tax Benefits for Angel Investors

- Taxation in Accelerator and Incubator Programs

- Taxation of Startup Exits (Acquisitions/IPOs)

Interesting Taxation Project Ideas For Beginners, Intermediate, And Advanced Level Students

Here are the super Interesting Taxation Project Ideas for each level of students.

| Level | Interesting Taxation Project Ideas |

|---|---|

| Beginners | Understanding the Basics of Income Taxation |

| Exploring Sales Tax: How it Impacts Consumer Purchases | |

| Introduction to Property Tax Assessment and Calculation | |

| Investigating Tax Deductions and Credits for Individuals | |

| Basics of Taxation in Small Businesses | |

| Intermediate | Comparative Analysis of Tax Policies in Different Countries |

| Impact of Digital Currencies on Taxation Regulations | |

| Evaluating Environmental Taxes and Their Effectiveness | |

| Taxation and Wealth Distribution: Analyzing Inequality | |

| Tax Planning Strategies for Corporations and Individuals | |

| Advanced | Tax Havens and Global Tax Avoidance Strategies |

| Analysis of Corporate Tax Evasion and Regulatory Measures | |

| Taxation and Economic Development: Case Studies | |

| Assessing the Impact of Tax Reforms on Socio-economic Factors | |

| Future of Taxation: AI, Automation, and Policy Implications |

What Is Taxation And What Are Some Things It Is Used For?

Tax collection is a compulsory financial charge forced by governments, organizations, or property inside their wards. It is an essential wellspring of income for states to finance different public consumptions and administrations. Charges are required to help infrastructural improvement, social welfare programs, safeguarding, schooling, medical care, and other fundamental administrations that benefit society.

Governments utilize tax revenue for numerous purposes:

- Public Infrastructure: Tax funds contribute to building and keeping up with streets, spans, public transportation, and utilities, working with monetary development and availability.

- Education: Taxation supports educational institutions, giving resources to schools, educators’ compensations, informative materials, and scholarship programs.

- Healthcare: Tax revenues are distributed to medical services frameworks, financing clinics, centers, general medical projects, and clinical examinations to guarantee citizens.

- Social Welfare Programs: Governments use taxes to help social security nets, including joblessness benefits, government assistance, lodging projects, and help for weak populaces

- National Defense and Security: Funds generated from charges are fundamental for keeping up with military powers, public safety drives, and crisis administrations.

- Public Services: Charges support many public administrations, such as policing, squandering the board, and public park maintenance.

Final Words– Interesting Taxation Project Ideas

In conclusion, embarking on taxation projects offers a compelling journey into the intricate realm of fiscal policies and societal structures. From examining the behavioral effects of tax incentives to designing fairer taxation frameworks, the possibilities are vast and engaging.

Whether diving into the taxation from arising industries like cryptocurrency or investigating the effect of assessment changes on pay conveyance, these undertakings give essential knowledge into financial frameworks and social welfare. By undertaking such endeavors, we extend how we interpret tax assessment and add to molding more evenhanded and supportable financial strategies.

These projects are vital tools for fostering informed discussions and driving positive change toward a fairer and more prosperous society in a world where economic dynamics constantly evolve.